A tough year for the economy, characterised continued business and investment uncertainty, has been reflected in sub-par take-up across the UK’s regional office markets during 2023, according to Lambert Smith Hampton’s Regional Office Report for 2023.

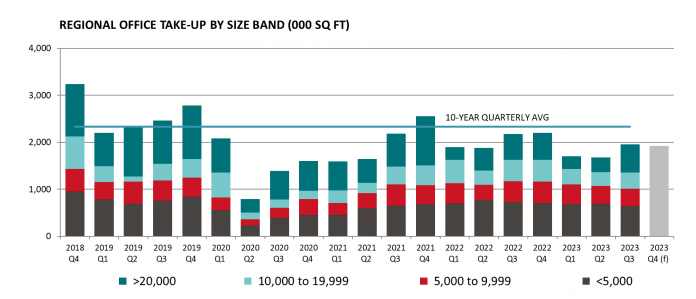

Including the forecast for the final quarter, take-up across the 20 key regional markets for 2023 is on course to hit circa 7.2m sq ft, 12% below 2022’s total and 22% below the 10-year annual average.

A paucity of large deals has adversely impacted take-up for the year as a whole, with take-up in 20,000 sq ft plus bracket running at half the ten-year trend through 2023 and reflecting elevated uncertainty among corporate occupiers. The picture looks brighter from an activity perspective, with the number of deals over 2023 to Q3 in line with both 2022 and the 10-year average.

Only three of the 20 key markets are set to see take-up in 2023 run ahead of their respective annual averages, namely Leeds city centre (+15%), South Manchester (+6%) and Sheffield (+3%). Leeds was home the only major regional deal in 2023, Lloyd’s Banking Group’s 124,400 sq ft pre-let at 11 & 12 Wellington Street, in Q1.

The well-documented flight to quality in the office sector means that quality Grade A space continues to attract the lion’s share of deals, accounting for 43% of take-up over 2023 to Q3. This is up from 42% in 2022 and compares with a 38% share in the five years prior to the pandemic. 2023’s share also takes on more significance given the thin activity witnessed at the larger end of the market, which normally drives grade A take-up.

Meanwhile, overall supply continues its upward trajectory, ticking up 3% since the beginning of the year to its highest level since 2016. However, available space that qualifies as ‘prime’ – defined as high quality product which boasts strong ESG credentials and a mix of high-quality amenities – makes up just 9% of overall supply.

Furthermore, 94% of prime supply is concentrated in the ‘big six’ city centre office markets. Birmingham city centre currently leads the pack, with prime availability of 572,000 sq ft making up 18% of the total, while Bristol and Manchester also offer a degree of choice, with prime supply making up 19% and 13% of total city centre supply respectively.

Robust demand for this new generation of buildings and best in class space has driven impressive rental growth at the prime end of the market. With several deals in the pipeline set to push rents onto new benchmarks in the final quarter, prime headline rents are forecast to increase by an average of 5.5% in 2023, the strongest annual rate in 17 years.

Glasgow, Newcastle and Sheffield have all witnessed a step change in tone, with prime rents rising in excess of 10% over the year. Bristol is on the verge of achieving the highest headline rent of any regional market, with space at the Welcome Building understood to be under at £45.00 per sq ft.

Meanwhile, the investment market has been especially subdued in 2023 due to a cocktail of structural change in occupier demand, perceptions around low occupancy, concerns over ESG remediation costs and a mismatch between seller and buyer pricing expectations. Over the year to Q3, total regional office volume amounted to £1.3bn, 58% the ten-year annual average.

Positively, however, recent times have brought a tentative improvement in sentiment and increased large deal activity. In Q3, Praxis purchased Brindleyplace, Birmingham for £125m (NIY circa 12%), while in Q4, Middle Eastern investor Menomadin’s purchased the Co-op’s HQ at 1 Angel Square, Manchester for £140m (NIY 7.17%).

Signs of improving investment activity partly reflect improving certainty in financial conditions. The spread between 10-year gilts and prime yields across the Bix Six regional office markets now stands at a relatively comfortable 200 basis points, arguably denoting fair value. However, finance costs remain stubbornly high, standing at around 7% for prime assets, meaning cash buyers hold all the aces in the current market.

Peter Musgrove, Senior Director and head of South West and Wales at LSH, said:

“Growing occupier preference for quality and flexibility are borne out in the statistics, with demand focusing on the very best space the markets have to offer. Crucially, occupiers are content to pay a premium for prime space, driving rates of rental growth that appear disconnected with the prevailing economic climate.

“Occupiers’ focus on quality and evidence of strong rental growth for best-in-class workspace is both an opportunity and a dilemma for landlords of secondary buildings. Given the recent rapid escalation of finance and build costs, significant capital expenditure is required to reposition existing buildings to be better aligned with shifting post-pandemic demand.

“As certainty begins to improve, consolidations are likely to play a key role in stimulating corporate occupier activity in the new cycle. Some fantastic opportunities are likely to emerge in 2024 and investors would be well advised to strike sooner rather than later.”

Charlie Lake, Director, Senior Director – Office Advisory and Capital Markets at LSH, said;

“While the investment market is still coming to terms with a significant pricing correction over the past year, huge opportunity exists to deliver the high-quality workspaces that occupiers really want and are willing to pay for. Pricing for secondary office buildings has now softened to such an extent that the case to viably refurbish assets to the required standard is becoming increasingly compelling.

“As prime yields reach a 10-year peak and with the prospect of some interest rate stability on the horizon in 2024, it is no surprise to see some savvy investors calling the bottom of the market and embracing opportunities to get ahead of the curve for the start of another cycle”.