According to the latest annual study on the Central European Industrial market released today by Cushman & Wakefield, the industrial real estate market in Central Europe has reached equilibrium. Availability of space has maintained a healthy 10.5 per cent for two years and the volume of new construction amounted to 740,000 square metres last year, with new construction taking place in Poland in particular.

According to the latest annual study on the Central European Industrial market released today by Cushman & Wakefield, the industrial real estate market in Central Europe has reached equilibrium. Availability of space has maintained a healthy 10.5 per cent for two years and the volume of new construction amounted to 740,000 square metres last year, with new construction taking place in Poland in particular.

“The capacity of the market with regard to new construction in Central Europe is estimated at between 500,000 to 1 million square metres a year. Such an amount of modern logistic and production halls needs to be built every year. Only then will there be a natural renewal of the premises offered, and companies that are newcomers to the market or that expand their operations will have premises to choose from when they want to lease,” says Ferdinand Hlobil, head of CEE Industrial Team at Cushman & Wakefield.

Supply

In 2012, new construction was concentrated mainly in Poland (514,000 sq m) and partly in the Czech Republic (106,000 sq m) and Slovakia (82,000 sq m ). In Romania and Hungary, new construction amounted to only about 20,000 sq m. The most active developers in the region were Panattoni, Goodman, Prologis, CTP, and SEGRO (see a graph in the PDF file).

“The first five companies ensured 70 per cent of all new supply. With the exception of CTP, they are strong international players active in the majority of European countries,” notes Ferdinand Hlobil.

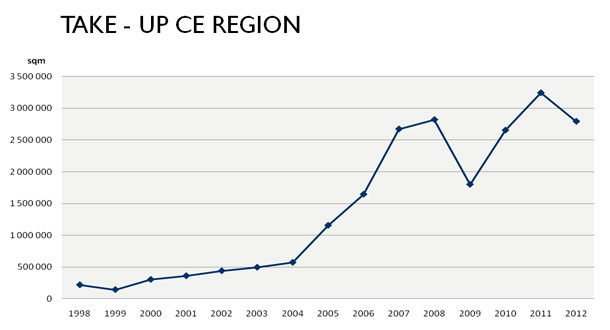

Take-up

In 2012, there were a total of 2.8 million square meters of modern industrial halls leased in the region (the Czech Republic, Hungary, Poland, Romania, and Slovakia), of which more than half were in Poland (1.5 million sq m) and roughly one-quarter in the Czech Republic (670,000 sq m ). The average for the past five years amounts to 2.7 million square metres a year, which means that last year was slightly above average. A record volume of leases was historically reached in 2011, when a total of 3.2 million square metres were leased in the region.

“With just under half of total modern stock in the region being located in Poland, the industrial market is continually expanding with new phases of existing parks as well as new locations opening up as a result of recent improvement in road infrastructure. Although leasing activity for 2012 fell short of figures recorded in 2011 it is important to note that new developments and space coming on to market last year was up by nearly 25% compared with 2011, a very positive sign that the major industrial developers see further growth potential in the Polish market and will look to continue to develop new warehouse schemes to satisfy tenant demand,” says Tom Listowski, Partner, Head of Industrial in Poland & CEE Corporate Relations, Cushman & Wakefield.

Vacancy

In the region, there are over 15 million sq m of modern premises, of which 10.5 per cent remains available to be leased (approximately 1.6 million sq m). This is an average for the whole region, with the differences between the individual countries.

“The vacancy rate in most countries amounts to between 7.5 and 11 per cent which is very close to the “healthy” 10 per cent The lowest vacancy – 7 per cent – can be found in the Czech Republic. Such figures mean that there is potential for new construction in the region.,” comments Ferdinand Hlobil.

Rents

The basic rent has been stable for over a year, ranging between EUR 3.5 and EUR 3.7 per sq m a month, depending on the location. The highest rental values are found in the most attractive places, near capital cities in particular, where there is plenty of available space, and tenants can enjoy incentives from developers.

Prospects for the future

In the near future, we are expecting a slight expansion of new construction and continuous renovation of existing halls in Central Europe. The times of rocketing construction, when the market had to make up for a lack of modern industrial premises from previous decades, are irrevocably gone. In the past 15 years, Central Europe has come significantly closer to the density of the logistics network of Western Europe.

“The construction of industrial real estate still remains an attractive segment – last year alone, around EUR 350 million was invested into construction in the region. We expect that this level will also be maintained this year,” says Ferdinand Hlobil.

“Last year, in Germany, slightly over 1.5 million square metres of modern industrial halls were built. That is roughly double the volume of premises in Central Europe and Romania combined (740,000). With regard to the economic growth in Germany and significantly higher purchasing power of its population, the construction activities in the Central European region can be considered to be very decent,” concludes Ferdinand Hlobil.