Activity has returned to the UK’s regional office markets, with Q3 representing 2022’s strongest period for regional offices take-up. Across the 20 key regional markets covered by Lambert Smith Hampton’s (LSH’s) regional office report, take-up for the past quarter hit 2.1m sq ft, just 6% below trend.

Though take-up across the 20 key regional markets for 2022 is forecast to end up marginally below 2021’s total, the volume of deal activity has increased, indicating improved demand at the smaller end of the market, with the number of deals in 2022 up to Q3 8% above the average across 2021.

In line with evolving occupancy trends, we are continuing to see a consolidatory shift in the market. While take-up in the largest 20,000 sq ft plus bracket was 45% below the 10-year trend over 2022, the next largest 10,000 sq ft -19,999 sq ft bracket was the most resilient of the four size-bands, with take-up 3% ahead of trend.

Evidence also points to occupiers’ continuing focus on quality over quantum in the wake of the pandemic. Grade A space accounted for 43% of 2022 YTD take-up, down from 2021’s record 46% share but ahead of the 39% overall share from the past ten years. 2022’s result is all the more impressive given the limited number of major corporate deals that typically drive grade A take-up.

Beneath the macro trend, five of the 20 key regional markets are set to see take-up in 2022 as a whole run ahead of their respective annual averages, namely Bristol, Sheffield, Liverpool, and Exeter. Boosted by the BT deal, Sheffield is on course to be 2022’s lead performer with 2022 forecast at 22% above the annual trend.

Meanwhile, overall supply across the 20 surveyed markets has picked up steadily since the pandemic, rising by 10% from the beginning of the year to its highest level since 2016. Despite the uptick, the rise is far less pronounced in comparison with Central London, where a substantial volume of second-hand space has come back to the market since the pandemic.

Across the 20 the markets, prime headline rents are forecast to increase by an impressive 7.2% in 2022. The calculation, which reflects growth in the year to Q3 and the forecast for Q4, represents the strongest annual rate of growth in over 20-years. This is led emphatically by Cardiff, where annual growth of around 30% will be secured should PwC commit to One Central Quay as expected.

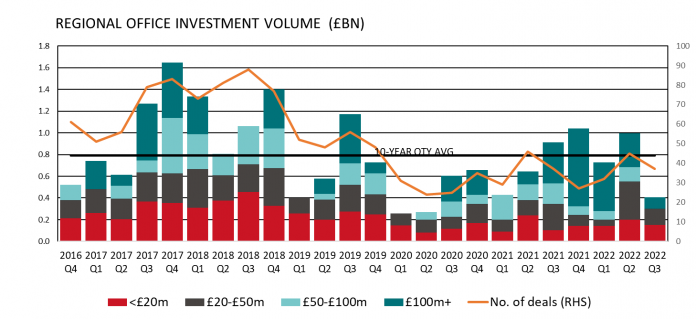

Meanwhile, in the investment market rocketing inflation and rising interest rates saw many investors move to the sidelines. This was clearly reflected in volume, where, following a decent, year-long run of above trend volume, only £390m of regional offices changed hands in Q3, tumbling by 60% from Q2’s strong outturn and just half the 10-year quarterly trend level.

While the financial climate has calmed since the tumult of the mini-budget in September, the shift has forced significant price downgrades for regional offices. While evidence is limited, sentiment implied that prime yields across the regional markets shifted by circa 50bps during Q3, with a further 50bps to 75bps softening potentially needed to attract buyers. In the case of the core markets of Manchester and Birmingham, for example, this would imply prime yields moving out to circa 5.75%.

Ryan Dean, head of office advisory, LSH said;

“The pandemic’s legacy of massively increased hybrid working is pressuring occupiers in ever greater numbers to exchange quantum for quality, in the process fuelling strong rental growth. The pressure to do so has also strengthened on the back of unprecedented rises in energy costs, with the business case for occupying environmentally efficient buildings now working alongside the increasingly accepted ethical case.

“Occupiers’ focus on quality and evidence of strong rental growth for best-in-class workspace is both an opportunity and a dilemma for landlords of secondary buildings. Given the recent rapid escalation of finance and build costs, significant capital expenditure is required to reposition existing buildings to be better aligned with shifting post-pandemic demand.”

Charlie Lake, director, capital markets, LSH said;

“The rising cost of capital has seen yields on good quality, well-let income producing assets move out considerably, while residual values on secondary assets have declined sharply due to the uncertainty of where prime yields will ultimately stand after repositioning.

“However, against a backdrop of sustained occupational demand for grade A assets with strong ESG credentials, the appearance of a number of forced sellers has arguably created a unique buying opportunity at this point in the cycle, particularly now that interest rate expectations appear to be moderating.”