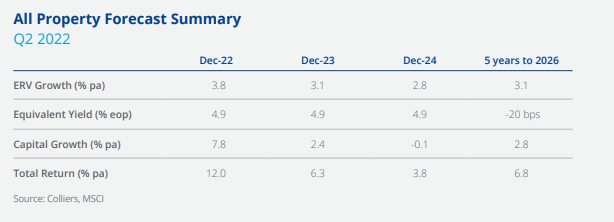

Colliers predicts sustained total returns growth in 2022 of 12 per cent following a strong start to the year for the investment market – an upward revision from the 9.6 per cent growth rate it predicted in February.

In the latest Real Estate Investment Forecast report, the firm also highlights that while UK property yields in several sectors have fallen to record lows (e.g. London offices, industrial), the gap to gilts has not. Despite further increases in gilt rates this year, Colliers predicts a general hardening of property yields in 2022. At the all-property levels, yields will move from 5.15 per cent at the end of 2021 to 4.87 per cent this year.

Oliver Kolodseike, director in the Research & Economics team at Colliers, comments: “Although gilt rates are rising and yields are still compressing, we believe that the gilt to yield gap will settle at around 270bps. Negative yield gaps as we have seen in some sectors in 2007 look unlikely given greater equity exposure.

“After a very challenging 18 months during which travel restrictions prevented many overseas investors, especially from the Asia-Pac region, to physically inspect and view buildings, we are now seeing a return of this investor group. The global weight of capital will continue to drive demand for UK commercial real estate.”

The report notes that all-property total returns growth reached a six year high of 16.5 per cent last year, driven by industrial (+36.4 per cent) and retail warehouses (+21.9 per cent) and the firm expects sustained double-digit growth in 2022.