BNP Paribas Real Estate’s (BNPPRE) Next X locational analysis research has revealed the top UK regional communities with the most significant real estate investment potential.

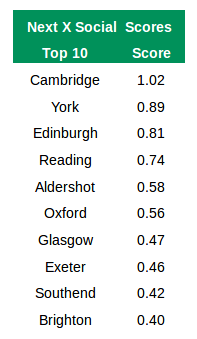

According to Next X’s social index, Cambridge, Reading, Exeter and Aldershot scored amongst the highest against community focused metrics including access to good-quality childcare, food and beverage and independent retail offering, resident engagement with the high streets, local business resilience and access to local talent – factors which BNPPRE say demonstrates a strong case for real estate investment, with the rise of ESG.

Brighton and Southend also made the top of the list, illustrating that seaside locations are becoming more investable post-pandemic. Edinburgh and Glasgow were the only two of the “Big 6” regional cities to be included.

Interesting statistics include Reading (75%) and Aldershot (73%) with the highest proportion of residents in Acorn Categories 1-3, indicating above-average consumer spending power; Burnley (83%), Aldershot (75%) and York (74%), having higher 2-year average business start-up survivability rates versus bigger cities and Edinburgh with the highest percentage of the working population with a qualification at NVQ4 or above, outperforming the Oxford-Cambridge-London ‘golden triangle’.

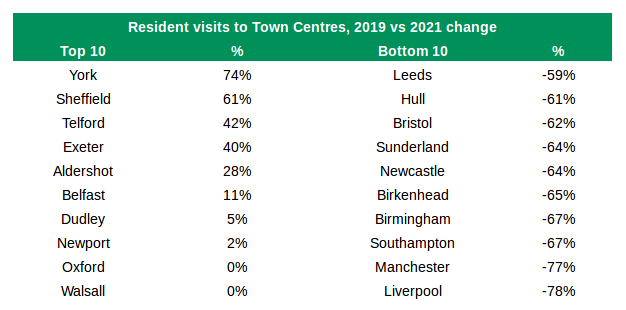

BNP Paribas Real Estate partnered with the AI-driven geolocation data platform Visitor Insights to provide footfall data for the analysis index, which found that the average 2-year growth rate of visits to independent businesses on high streets in Next X locations outside London was circa 78% between 2019 and 2021. This is much higher than the average for general retail occupiers, which was -6%.

Resident visits to high streets in locations like Aldershot and Exeter actually grew substantially in relation to a pre-pandemic baseline in 2019, whereas resident footfall in the Big 6 regional cities is still lagging far behind.

Charlie Tattersall, Associate Director, Research at BNP Paribas Real Estate commented: “The unique challenges of the last two years have forced millions across the UK to re-evaluate where they want to live, work and play. Following this rapid socio-economic change closely is fundamental for real estate occupiers and investors to understand the trends driving the evolution of built environments and achieve market success.

“By overlaying our real estate market expertise with our Next X analysis, we can clearly see how there is underlying value for real estate investors and occupiers in locations with strong community spirit and cohesion, and this should influence real estate decision makers when targeting new markets.”

Isabelle Hease, CEO of Visitor Insights added: “The application of geo data is giving real estate professionals an invaluable understanding of how engagement with communal spaces and town centres is changing as well as the evolving nature of our high streets. Powered with this intel, they are moving away from the misconception that regional destinations are a risky investment”

“A strong, independent retail offer is now a deciding factor when looking at the liveability of an area, and with localised retail destinations witnessing an uptick in popularity, we can evidence this as a move towards secondary locations becoming increasingly attractive business targets.”

NEXT X is unique location analysis model fully customisable to real estate portfolios. It goes beyond traditional location analysis measures to give investors and occupiers new ways of looking at how UK towns and cities can help deliver their business strategies.