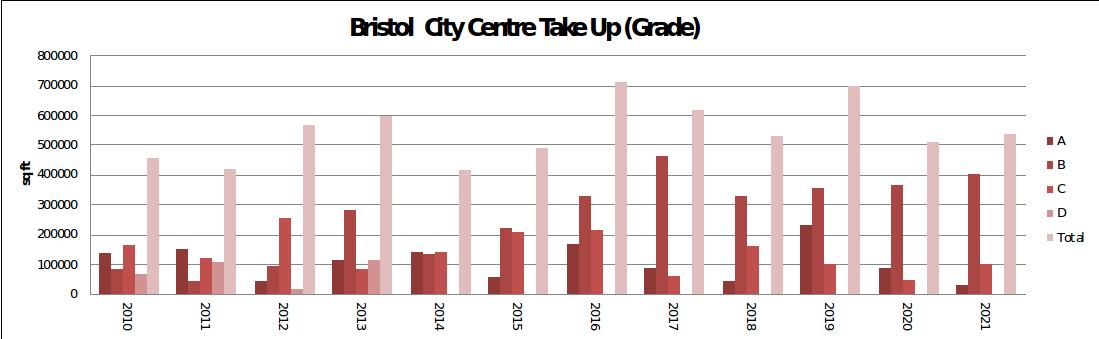

After nine months of many Bristol occupiers delaying decisions, Q4 burst into action with 31 city centre deals totalling 249,944 sq ft – over half of the year’s total of 540,910 sq ft, as reported in the latest edition of Morton Property Consultants’ Market Monitor.

The rally came as many businesses completed their property strategies and came to decisions on the sort of workspace they will need to take them forward in a post-Covid world… one where hybrid working in higher quality environments will be the norm.

To put Q4 into perspective, it was ahead of the five-year average, while 2021 itself was below that benchmark. In contrast, the 25 deals in Q3 totalled 71,011 sq ft.

The stand-out deal of Q4 (and the year) was Bristol University Dental School taking a 17-year lease on 74,373 sq ft of unrefurbished space at 1, Trinity Quay at £26.50 psf – close to the proposed new University campus. They will be moving to the new site in 2023 after outgrowing their existing premises at the Dental Hospital in Lower Maudlin Street.

The education sector, which is helping to drive the market in Bristol as well as repurpose many former office buildings, was also responsible for Q4’s second biggest deal: BIMM describes itself as “Europe’s largest, most connected music institute with eight colleges based in vibrant musical cities across the UK and Europe,” and their Bristol college, whose alumni include singer George Ezra, took 32,731 sq ft at St James’ House in Stokes Croft. It will be completely refurbished in time for September 2022 with study spaces, recording studios and edit suites, rehearsal rooms and lecture rooms.

ARUP have completed their pre-let at EQ, taking 27,377 sq ft on the second floor.

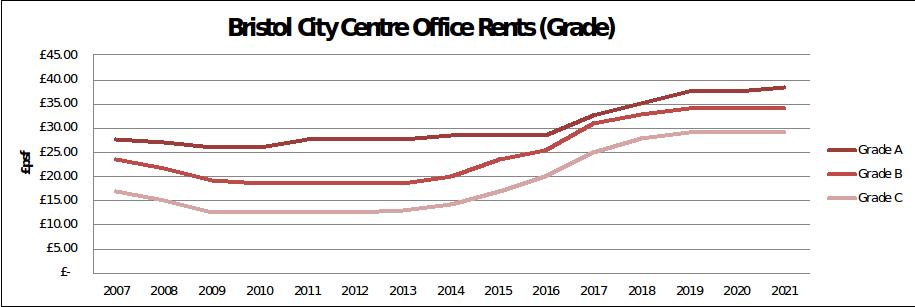

While headline rents in Bristol topped £38.50 during 2021, that is very likely to be surpassed with some of the deals currently under offer.

The quarter’s other deal to exceed 20,000 sq ft was at Bridgewater House, where lawyers RPC have followed the BBC (who acquired 60,251 sq ft in Q2) and taken 20,951 sq ft.

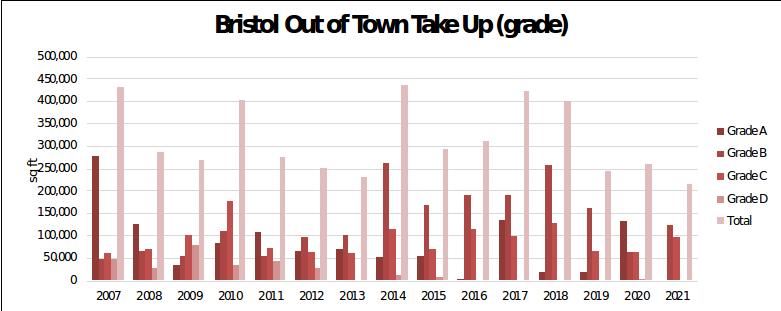

Out of Town continues to lag well behind the city centre: Q4 take up of 57,924sq ft followed a similar figure in Q3 and brought the annual figure to 214,969sq ft… slightly down on the five- and 10-year averages but close to 2019 and 2020 stats. The largest deal was KKP Group acquiring 14,453sq ft at Beech House, Almondsbury Business Park.

It’s fair to say that the anticipated boost to Out of Town because of Covid concerns has not materialised. Hopes still ride on the refurbishment of Aztec 1000 introducing a new type of product, one more in line with the sort of workspace now in demand in the city centre.

Reading the runes…

So, what does all this say about the current market? Well, a corner has been turned and the overall picture is very positive.

Critically, as the section below highlights, more high-quality space is coming on stream and this flow is helping to maintain a healthy balance between supply and demand, providing all-important certainty around rents and yields for developers, while maintaining rents at a sensible level and encouraging churn.

The space available is across a wide range of specifications and locations: if you want cheap and cheerful it’s there to be had, through to 92,000 sq ft of prime new space ready to occupy. In the pipeline are lots of high-quality refurbishments compliant with the demands of today’s ESG-conscious businesses, together some high-quality space in the pipeline for those occupiers looking further ahead.

Pre-Covid, tenants were asking for extra bells and whistles on their ESG spec, but passing on it when faced with that being reflected in the rent. Now they are more willing to shoulder the cost.

Rents are set to push past £40 this year, and while behind the headline figures, rent frees have pushed out slightly on good quality kit, in the dash for quality a gap is appearing between these deals and those for poorer quality, unrefurbished, non-ESG compliant buildings, where some significant rent frees are being seen.

Another notable trend is that fewer parking spaces are becoming the norm – and accepted by tenants. Typically, new schemes are offering one for every 6,000 sq ft, with the emphasis now on bike spaces and changing facilities. With more people whizzing around on e-scooters, it’s only a matter of time before private ownership will be allowed, and occupiers will expect dedicated charging bays.

New builds under construction

The number of cranes on the skyline is an encouraging sign for the city. Major projects underway include:

- CEG’s EQ (200,000 sq ft)

- Nord’s 1 Portwall Square (33,000 sq ft)

- Bell Hammer’s Assembly C (92,716 sq ft)

- Umberslade’s CARGO Work (20,270 sq ft)

The latest scheme to have the start button pushed is Tristan Capital’s Welcome Building (formerly known as 4 Glass Wharf) Temple Quay. The standout feature of the 207,000 sq ft building is probably the big floor plates. As well as scoring highly on ESG, the building will develop a point of difference with staff greeting you at the entrance… hence its name.

Refurbishments currently proceeding apace include V7’s Dock House (11,750 sq ft), XLB’s 70 Redcliff (14,965 sq ft) and Northwood’s 10 – 22 Victoria Street (47,000 sq ft).

All this will help agents, occupiers and landlords as a relatively liquid market enables businesses to move to the sort of space they are after, but with no signs of oversupply. Indeed, the one potential gap in the market would be if someone wanted 100k of good quality space in a hurry… but that sort of requirement typically only comes along once every three years in Bristol.

Rise of the “Awesome Office”

There’s been plenty of talk in the past about the impact of hybrid working on the office market, and the Work from Home (WFH) trend that Covid helped to accelerate. What is now emerging is a maturing of this trend, as business leaders look beyond occupational costs and recognise that investing in high quality space (albeit in smaller amounts) will help them recruit and retain quality staff: an holistic approach that’s well worth investing in.

Early on in the pandemic, there appeared to be differences emerging between sectors, with call centres, for instance, less keen on staff working from home than tech or creative businesses. Now lines are becoming more blurred and management philosophy appears to be the critical factor in how much emphasis is placed on attracting employees into work, and how keen they are to embed the organisation’s culture and values.

If senior management regularly engage with staff, and this is seen as a key part of the culture, then the percentage of time they would like staff in the office – collaborating, mentoring, socialising, building trust – will be significantly greater. Making the effort to go in themselves sets an example to other personnel, and ultimately leads to better communications, the sharing of ideas… and greater productivity.

Flexible working will still be a key attraction; but for many junior staff, going into the office can be crucial – for their future prospects as well as their mental wellbeing.

That leads on to the concept of “FOMO” – the fear of missing out: not usually discussed in open forums and often seen as a sensitive subject.

If junior personnel are mixing with senior colleagues, they will benefit by the relationships they form – networking for the future, mentoring, having their talent recognised. Although senior management cannot force staff to return to the office, they can do a lot to make the workplace attractive – and reduce time consuming one-on-one meetings.

Graduates coming through will see what’s available to advance their careers and choose where to work on the basis of which companies provide most support. What we’ll term “an Awesome Office (AO)” will be seen as part of the employment package – along with salary, pension, flexible working, training opportunities and healthcare.

So perhaps Covid has done us all a favour in helping to focus on what really matters within a business and, more pertinently for the purposes of this review, what needs to go on inside our workspaces to make businesses more productive for employers… and more attractive to employees.

Are you AO ready?