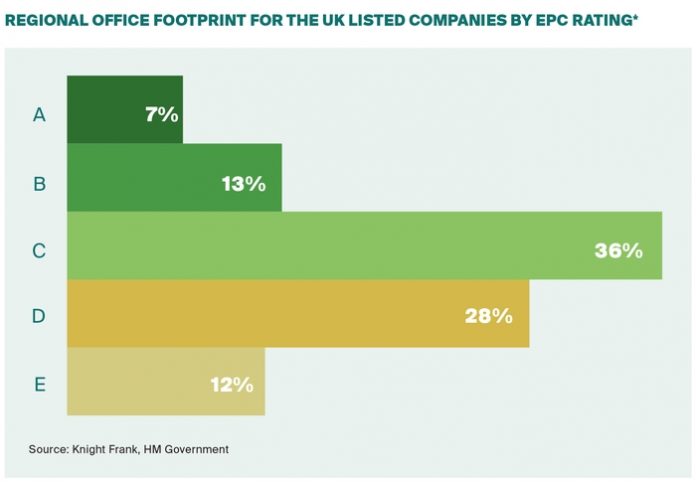

Analysis by global property consultancy Knight Frank found that just 20% of regional offices space occupied by leading listed companies in England and Wales holds an EPC rating of A or B, the standard required by 2030, and only 56% with the standards potentially required by 2027.

The revised Minimum Energy Efficiency Standards (MEES) set out by the government last summer confirmed that a minimum required EPC rating of ‘B’ will become mandatory for all commercial premises by 2030. Additionally, the 2020 Energy White Paper suggests there will be a phased approach, with EPC ‘C’ required by 2027.

Knight Frank analysed the EPC ratings of office space occupied by the largest UK listed companies across major cities in England and Wales, finding that 80% of buildings do not comply with the upcoming regulations and therefore occupational real estate could be undermining organisational targets aimed at achieving net zero.

For those companies looking to relocate operations, analysis also shows that there is a critical shortage of high quality, green rated office stock across the UK cities, with just 18% of available space rated EPC ‘A’ or ‘B’. This could mean greater occupier engagement with the development pipeline moving forward, albeit with 40% of pipeline space across the main cities already leased, competition will be fierce.

Darren Mansfield, Partner in Knight Frank’s Research team, comments: “With organisations increasingly environmentally conscious, many are making public net zero commitments and in so doing, are risking reputation in its pursuit. The real estate footprint of companies can contribute significantly to the realisation of a net-zero pathway, and it is startling that 80% of office buildings occupied by the UK’s leading firms that we analysed fell outside of the forthcoming guidelines for EPC rating.

“This scenario can only lead to greater action real estate markets. Landlords will look to invest in improving the environmental credentials of buildings to mitigate against the potential risk to investment and rental value. Tenants will also enact relocation requirements in greater number where ambitions are not being met. This will mean further supply pressure in many markets.”

Alastair Graham-Campbell, Partner and Head of UK Cities at Knight Frank, adds: “The shifting focus of occupiers means that landlords are being forced to embed environmental credentials into market offering well ahead of any regulation. The change though is not without reward, as highly rated green offices are now starting to reflect this positively in sales and rental pricing.

“Environmental and ESG criteria as a whole, is now very much a point of differentiation between assets. Further development and/or redevelopment of highly sustainable office buildings is vital for the future success of the UK regional office market. Schemes such as Eden in Manchester, a 110,000 sq ft speculative development at New Bailey designed to meet the UK Green Building Council net-zero carbon, is a prime example of an asset with significant ESG credentials that will draw in both occupiers and investors.”