The explosive growth in occupier demand for European industrial and logistics assets during the Covid-19 pandemic, fuelled by a surge in ecommerce volumes, will maintain momentum in the medium term while supply constraints will persist as economies recover. Investor demand, which soared in the past 18 months, will also remain strong until at least the end of 2024, according to the results of the first pan-European Logistics Real Estate Census conducted across all major markets.

The Census, carried out in the summer of 2021 by supply chain market analysts Analytiqa on behalf of Tritax EuroBox plc, a leading investor in European logistics real estate, and international real estate advisor Savills, received 412 responses from large companies across all areas of the pan-European market.

Nick Preston, Fund Manager at Tritax EuroBox plc, said: “The results of our first pan-European Census confirm our view that occupier and investor demand for logistics properties in Europe will remain strong for at least the next three years, led by the major French, German, Spanish and Italian markets, where sentiment is notably upbeat. With an increasing lack of adequate supply of new warehouse space cited as the top challenge for the logistics sector by all respondents, there will continue to be sustained upward pressure on rents and ongoing yield compression, particularly in those European markets where supply is most constrained. The pandemic has accelerated long-term structural growth drivers, and the results of our Census clearly underline that these will remain strong and resilient beyond 2024.”

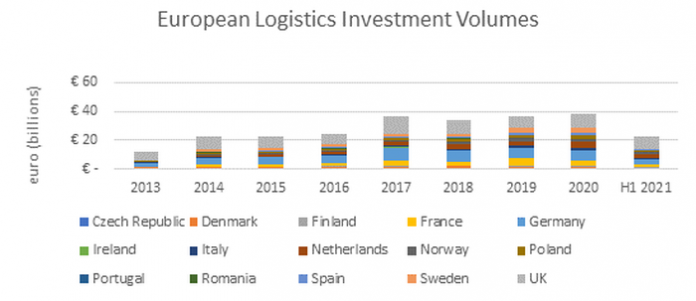

European logistics real estate take-up by occupiers in the first half of 2021 was 60% above the average for the same period over the last 10 years. Vacancy rates also fell to a record low of 4.6% across European markets between January and June this year, and headline rents have risen by 2% over the last 12 months, led by Lisbon, Warsaw and Hamburg. European logistics property investment reached a record €22.5 billion in H1 2021, a 60% rise over the five-year average, and yields have compressed by 45 basis points year-on-year in the same period, with asset prices in the French and German markets advancing the most.

Marcus de Minckwitz, Head of EMEA Industrial and Logistics, at Savills, said: “The Census clearly underlines our belief in the long-term strength and performance of the logistics sector. It is no surprise that we have seen record levels of investor interest in recent years and asset pricing has increased as a result, but we can be very confident about the continued growth of the sector moving forward, based on an overriding positive sentiment.”

Key Highlights: Fundamentals remain robust and resilient for the long-term

Over 80% of European investors and asset managers surveyed expect industrial and logistics investment volumes to rise in the next year. No respondents anticipate a fall in transactions. France, Germany and the Netherlands are the three most favoured European destinations for investments among investors and assets managers who do not currently own assets in these markets.

Among occupiers, 46% predict that their space requirements will rise, with only a small group (4.8%) expecting to make a reduction over this period for all of the European markets surveyed. At the country level, the majority of occupiers in three major markets – France (44.1%), Germany (42.6%) and Spain (38.5%) – are projecting an expansion in take-up, with Italy and Portugal following at 26.4% and 24.2% respectively.

By far the biggest operational challenge for the European logistics real estate sector is the lack of supply of new buildings according to 30% of all respondents, with those citing development zoning and permits coming in a distant second at 13.6%.

More than half of all respondents in the Census (51.9%) reported increased growth and a further strengthening of their business during the pandemic. Lessons learned from the pandemic are expected to support the long-term positive structural shifts in the European logistics property industry, with the most significant expected to be the shortening, or ‘re-shoring,’ of supply chains to mitigate risks.

Occupiers most concerned about rising rents due to supply constraints

Occupiers rate the affordability of rents (93.8%), the potential for extensions (93.3%), flexible leases (88.2%), a good power supply (86.7%) and staff wellbeing (86.7%) as the top five most ‘important’ or ‘very important’ factors for their operations. Sustainability features, including power, ranked sixth (73.3%).

The picture is very similar for logistics investors in the Census, with building location (94.1%) and covenant strength (84.7%) being rated as ‘important’ and ‘very important’ in their investment selection criteria. Future building obsolescence (75.3%) and sustainability features also ranked lower in this group’s list of priorities.

Nick Preston, Fund Manager at Tritax EuroBox plc, added: “Given the enormous and growing demand for industrial and logistics properties from occupiers and investors, combined with ongoing supply constraints, it is understandable that most respondents in both these groups are currently prioritising financial and operational factors. However, the growing sense of a global urgency for action, further strengthened by the recent IPCC report on climate change, is likely to produce a very different ranking of importance for sustainability by occupiers and investors in future editions of our Census. Financial and operational factors will increasingly merge with sustainability priorities and determine the speed at which assets become ‘stranded,’ or obsolete, in the future. The European logistics real estate market is transitioning rapidly from obsolete ‘brown sheds’ to ‘super smart, sustainable, resilient and green big box logistics assets.’”

Business booms as favourable conditions persist across the European logistics and industrial sector

More than half of all respondents in the Census (51.9%) reported increased growth and a further strengthening of their business during the pandemic, with less than a fifth (17.5%), experiencing a decline.

Landowners are overwhelmingly upbeat about the current state of the market, with all respondents in this group being more favourable about business conditions as compared with the previous six months. This is a significantly more positive outlook than for other groups of respondents. Developers and investors came second and third respectively, followed by occupiers. Only 16.5% of occupiers are reporting business as being ‘somewhat more difficult’ and 4.9% ‘much more difficult.’

Lessons learned from the pandemic are expected to support the long-term positive structural shifts in the European logistics property industry, with the most significant expected to be the shortening, or ‘re-shoring,’ of supply chains to mitigate risks (18% of all respondents). Related to this was the predicted increase in the quantity of stock held (15.3%) and a reduction in reliance on foreign imported materials (12.8%). More staff working from home (16.2%) and increased capacity to facilitate online sales/business (16%) rank as the second and third most anticipated changes stemming from the pandemic.

The key current concern for nearly a quarter of occupiers is rising operational costs (23.8%), followed by issues relating to constrained logistics real estate supply relative to growing demand, including, in order of ranking: increased customer demand for delivery (21.5%); availability of warehouse space (18.2%); more online purchases (14.4%); availability of labour (13.3%); managing international trade (12.7%); end consumer price issues (12.2%); the pace of change towards new retail channels (10.5%); the state of the retail market (9.9%); and economic uncertainty driven by Covid 19 (9.9%).

Kevin Mofid, Head of Industrial Research, at Savills, concluded: “The outcomes of the first pan-European Census of market sentiment in the industrial and logistics real estate sector are closely aligned with what the underlying data tells us. We are in the midde of an unprecedented long-term structural market shift in the European logistics market, turbo-charged by the surge in ecommerce volumes during the Covid-19 pandemic and this shows few signs of slowing anytime soon.”