Research from The Instant Group finds that suburban office markets are outperforming City Centres for the first time in over ten years. The increased demand is largely being driven by those who no longer want to work from home, but don’t want to be back in larger cities. And also requirements from larger corporates who continue to experiment with the possibility of introducing a work-near-home model as part of hybrid working policy.

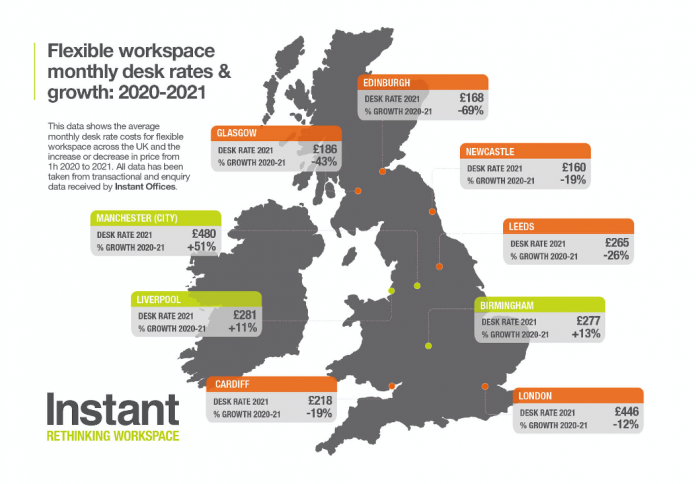

The research also found that six out of nine major UK cities are seeing lower workstation rates for space than they were a year ago with Birmingham, Liverpool, and Manchester being the only cities to experience increased rates.

Instant’s data found that locations such as Edgbaston, Bromley, Milton Keynes and Luton are seeing rates for office space increase whereas towns such as Croydon, Harrow and Salford are experiencing lower rates than they were pre-pandemic.

John Williams, Director, The Instant Group, comments on the findings:

“The pandemic has been the catalyst for driving innovation in the commercial real estate sector, particularly across the regions, but different parts of the country are being impacted by this change in different ways. Occupiers have the power right now and this is likely to be the case for the foreseeable future as we continue to see decreasing rates across key markets. In most cases this goes against the grain of the traditional real estate cycle which is a sign of a significant shift in the market.

“One of the major risks for companies is future uncertainty and for corporate real estate teams it is critical to reduce the level of capital expenditure as far as possible, this includes being more efficient and thinking innovatively about how they utilise their workspace. As the UK comes out of lockdown, businesses want to reduce CAPEX where possible and be ‘cash-rich’, ready to invest in growth strategies, new markets or research and development rather than be heavily invested in real estate.

“The office market is responding to this and we are seeing more variation with a greater focus from landlords in providing the type of space and environment that employees now want. Those eager to capitalise on this opportunity are starting to think about bringing lease term lengths in line with changing business cycles and looking at how can they value their asset differently to reflect changing customer demands as we adjust to a new of working.

“Unsurprisingly, with more hybrid ways of working coming to the fore, Interest in flexible workspace has rebounded strongly. We are seeing a greater level of transactions but with large amounts of uncertainty it is still a complicated process. In markets such as Australia , APAC and parts of the US where things are getting back to ‘normal’ demand volumes look healthy with transactions ramping up and we expect the same to happen in the UK and across Europe. For flexible workspace operators, those that listen to their customers and are able to respond quickly and innovatively will be the biggest winners.”