Property company Key Land Capital is planning a development of small industrial units after acquiring a site in Birmingham.

The plans have been unveiled after Key Land Capital purchased Kestrel House, a 16,600 sq ft unit on a 0.42 acres site for £700,000.

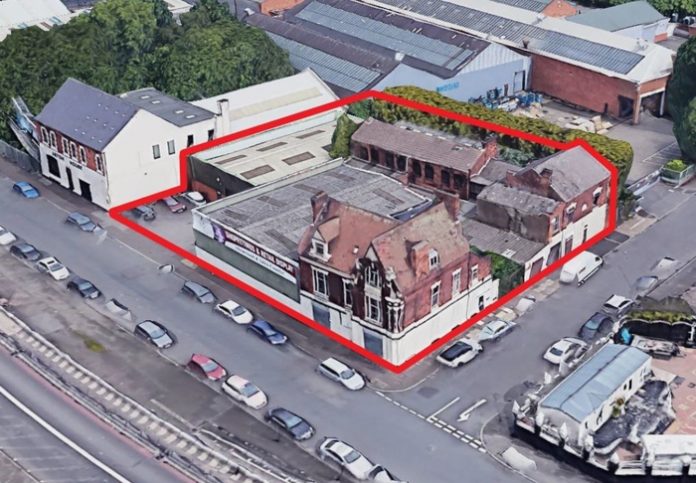

Kestrel House, at 57-59 Aston Brook Street East, is the former headquarters of Hobday Ltd, which traded as E-shopfitting, wholesalers of shop fittings and sign equipment.

The three-storey property was originally built in 1900 and comprises a variety of buildings, which have been acquired and adapted over time. It includes a showroom, stores and offices and links to adjacent warehousing, workshops and outbuildings.

Key Land Capital is an independent property investment and development company based in Birmingham. The business was the subject of a management buyout in May when co-founder Kevin Sharkey acquired 100% of the shares.

Managing director Kevin Sharkey said: “Aston is an area we have previously invested in and we see the site as offering a significant opportunity to add value.

“We plan to develop the site to provide a number of new build high quality B1(c),

B2, and B8 smaller industrial units. We will be retaining part of the site, the unit on Aston Road, and refurbishing this to provide a new trade counter-warehouse unit.”

A planning application will be submitted to Birmingham City Council in due course, with work expected to start on site in 2021.

Agents Siddall Jones, acting on behalf of the directors’ SIPP, completed the sale.

Ed Siddall-Jones, managing director of Siddall Jones, said: “The sale reflects the continued demand for industrial accommodation within the city. The Kestrel House site benefits from excellent communication links being situated next to the A38(M) Aston Expressway and this will allow the purchaser to reconfigure the site to accommodate today’s modern warehouse and trade counter users.”

Key Land Capital is delivering residential projects worth more than £40 million across the West Midlands. Its mission is to provide affordable, luxury and modern housing to students and professionals, whilst maintaining solid returns for investors. The company raises private investment to develop sites throughout the Midlands, a mixture of residential new-build and office to residential conversions.