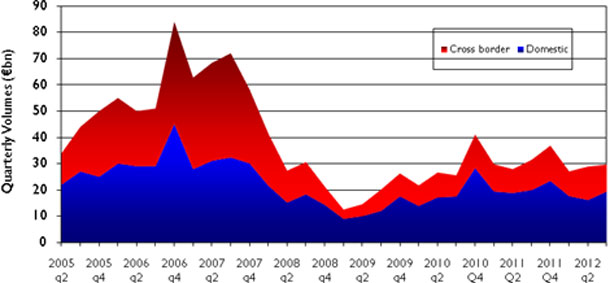

Investment activity rose marginally in Q3 thanks to a surge in domestic buying. While cross border players cut activity by 19.5%, domestic players more than made up for this, with 20% growth lifting their market share to 65% from 56% in Q2, notably in Norway, the Netherlands, France and the UK.

Investment activity rose marginally in Q3 thanks to a surge in domestic buying. While cross border players cut activity by 19.5%, domestic players more than made up for this, with 20% growth lifting their market share to 65% from 56% in Q2, notably in Norway, the Netherlands, France and the UK.

Commenting on the figures, Michael Rhydderch, Head of Capital Markets at Cushman &Wakefield, EMEA said: “Investors are eager to find secure income given the sustained low level of bond yields and while the market was understandably cautious in Q3, the fall in foreign activity really reflected a refocusing on larger, liquid core markets rather than a retreat from investment.”

Cross border players cut their buying activity in Southern Europe by 92% and in Eastern Europe by 75% over the 3 months. By contrast, the big 3 markets of France, Germany and the UK saw volumes rise from all players and by 14% overall, lifting their market share to a new high of 66%, from 59% in Q2. Nordic markets also benefitted from the hunt for safety and, while down slightly on the quarter, are well ahead year on year, with a market share of nearly 18% so far this year versus 15% last.

Larger lot sizes in particular continue to see robust demand in core markets despite the shortage of finance for bigger assets. This reflects the nature of the buyers or their backers, with powerful equity players, such as sovereign wealth funds, often seeking trophy assets. The last quarter yet again saw diverse interest from, among others, Middle Eastern, Chinese and European players in the UK, France and Germany, as well as high net worth individuals focussed on markets such as London and Paris.

According to Rhydderch, “Everyone wants to know how long the market will remain so concentrated and when risk appetites will relax. Interestingly while secondary remains off the radar for most, we are seeing some vendors reappraise the market and re-price their property to reflect both today’s risks and opportunities they perceive for re-investment. As a result, there are more deals in the pipeline for a broader range of markets and this bodes well for activity. Our current forecast is for volumes to rise slightly in the final quarter, by 2-3%, and to end the year around €116bn, just 9% down on 2011.”

By country, a number of smaller markets such as Austria, Poland and Luxembourg had a good Q3 but so too did larger markets Germany and the UK, rising 26% and 21% respectively. Norway, Switzerland and the Netherlands also performed well but some core countries such as Denmark, Sweden and France saw volumes drop, due both to the caution of buyers and a paucity of quality stock as well as tax changes in France. Central & Eastern Europe meanwhile saw volumes fall 40% between the second and third quarters despite a slight increase in some countries, such as Poland and Romania. A drop in Russia was the main factor holding down the region but it has had a strong year overall, led in particular by the retail sector.

Led by Spain and Italy, the indebted fringe of Europe (GIIPS) saw volumes fall 66%. The GIIPS overall had only a 1.8% market share compared to a peak of 15% in 2007 and according to Rhydderch, “With re-pricing taking place and opportunities from public and private sector sales awaited, some investors may start to anticipate more attractive opportunities emerging in these areas but not until a greater sense of stability returns.”

By sector, retail activity rose 22% while offices eased back 7.4% and industrial fell 21%. Over the year as a whole however offices have performed better, with volumes 19% up on 2011 compared to a 35% loss for retail and 15% for industrial.

David Hutchings, Head of European Research at Cushman & Wakefield, commented “Office volumes have benefitted from a number of larger deals in the last quarter but fundamentally the sector has been attractive to investors because it is relatively easy to understand assets in different countries and in prime core markets, values are well supported by a lack of new development and lower availability. In addition, new working patterns as well as a focus on sustainability are set to boost interest and demand for modern efficient office space going forward.”

Despite a fall in market share, retail is in strong demand, with a shortage of quality supply and finance for large schemes responsible for the drop. According to Hutchings, “Top high streets are performing robustly, with many benefiting from flagship and luxury retailer demand and attracting funds and high net worth players seeking security and long term growth. For those targeting higher secure incomes modern shopping centres are attractive as are parts of the logistics sector, with development pipelines down in both sectors but demand rising as retailers and suppliers react to e-tailing and higher costs.”