The UK’s flexible workspace providers have seen desk rates increase by 5% over the last six months compared to the same time period last year.

Consistent growth in desk rates during a difficult market is a very positive sign for the flex industry as demand in secondary cities continues to grow and providers focus on flexibility and increased value rather than discounting.

The market has been mixed, however, with some areas impacted more by lockdown. But those that have seen prices decreases are markets where supply has increased significantly thereby depressing desk rates.

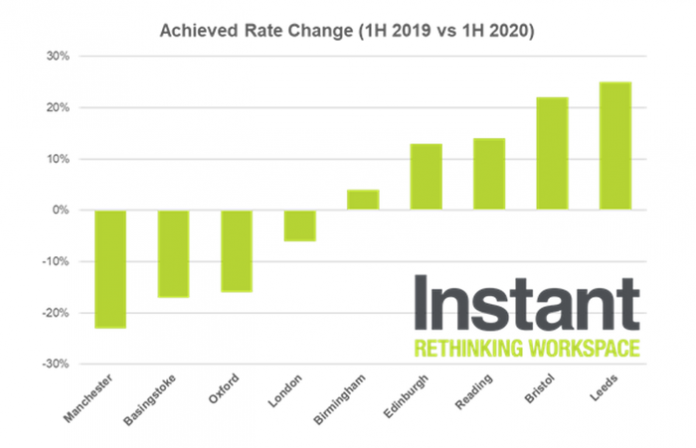

Research from The Instant Group found that in London, rates have only dropped by 6%, compared to other markets where increased supply means that rates have become more competitive. Average flex space rates have decreased by up to 22% in Manchester, 16% in Oxford and 17% in Basingstoke.

However, in markets such as Bristol, where demand remained more stable, Instant has seen rate increases upwards of 22%. With a higher occupancy rate in the west country than the UK average, it’s likely that providers in the city are less inclined to discount. Other markets which are experiencing higher rates compared to this time last year include Edinburgh (13%), Leeds (25%) and Reading (14%).

The impact of the stricture of lockdown can be seen across European markets with those cities where less strictures were in place seeing price growth over the last six months. Markets hardest hit, such as Spain, saw major declines by comparison as demand dropped away almost overnight.

As data from Instant shows, interest in the agile workspace market remained resilient during Covid-19 with early decreases in demand quickly bouncing back. At a global level interest is now 5% higher than it was pre-Covid-19 with markets such as the US up 18%.

John Duckworth, Managing Director UK & EMEA at The Instant Group comments: “As lockdown restrictions start to ease, we’re seeing an increased number of businesses considering a more agile commercial real estate strategy. This means offering employees the option of working from home, using the central main office or using a satellite office which is closer to home. It’s likely that many employees will choose a hybrid of all three.

“What this means is that businesses are looking for a more dispersed portfolio to help increase agility and reduce costs. This was always bubbling away under the surface but Covid-19 has really bought it to the fore.

“Pricing for flex solutions hasn’t really settled yet – we’ve seen a six-moth period of reality biting and as things start to change again, we expect to see supply increasing which will soften pricing. In major cities like London, we expect to see rapid movement as stock comes back to the market. The flex market is resilient and as we start to see the demand side shift, systemic change will happen inevitably having a deeper impact on pricing. Many companies are still in the fact finding stage and transactions may still take a number of months to return to pre-Covid levels, but all signs point to a very healthy year in 2021.”