The abrupt decline in leasing activity in London’s office market has already translated into falling rents with the worst still to come, according to office specialists from global membership body, the Society of Industrial & Office Realtors (SIOR).

A combination of stalled deals, increasing vacancy and lease breaks has slowed leasing activity down to 1.2 million sq ft in Q2 2020, representing a 57% drop on the previous quarter, according to figures from DeVono Cresa.

Based on the same data from DeVono Cresa, this has already impacted rental values with prime rents on Grade A space dipping by an average of 3% since Q1 2020. The biggest falls have been recorded in traditionally robust submarkets such as Mayfair (-8%) and Soho (-8%).

Paul Danks, director at DeVono Cresa, and president-elect of SIOR Europe, said: “As a result of the ongoing pandemic, we expect the lettings market to remain subdued compared with historical levels mixed with increased appreciation for flexible office space. This sudden increase in availability is already prompting a swing in the balance of power back towards the tenant.”

Though these figures are unsurprising, Nick McCalmont-Woods, CEO of McCalmont-Woods Real Estate, believes there is potentially worse news yet to come as the UK officially enters its first recession since the Global Financial Crisis (GFC).

“During GFC of 2008/2009 we saw an initial softening of rents in the immediate aftermath of Leman Brothers’ downfall. Yet, as the economy contracted and the recession deepened, landlords were persuaded to offer far more competitive terms to attract a dwindling pool of occupiers”, he said.

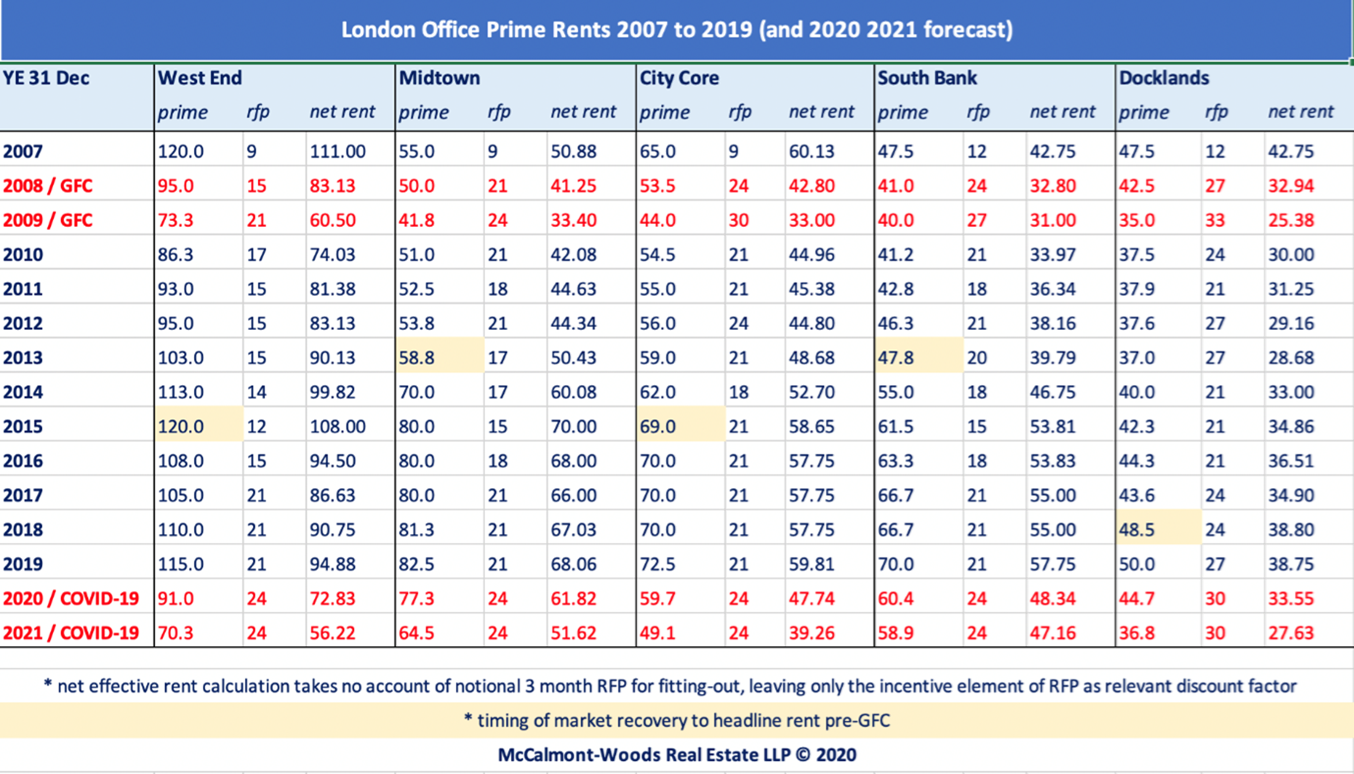

The analysis below from McCalmont-Woods Real Estate shows that, though London’s prime office rents experienced a decline of between 9% and 21% over the first twelve months of the GFC, it was another 12 months before the market hit bottom with prime rents having fallen between 16% and 39% from their peak at the end of 2007.

“As occupiers adjust to the impact of COVID-19 on their businesses and scale back, delay or even shelve some office requirements altogether, we expect the pattern of rental decline from the GFC to repeat itself and, if anything, it may be exacerbated further in the event that significantly more tenant/occupier controlled space is released back on to the market as businesses adopt new working practices in the long-term”, adds McCalmont-Woods.

Consequently, there is likely to be considerable uncertainty in the months ahead with rising unemployment, dwindling demand for space and an expectation that rents will tumble across the office sector. On that basis, we are unlikely to see the true impact of COVID-19 on rental levels before Q4 2021/Q1 2022 and cannot anticipate prime rents returning to 2019 levels any time before 2022 and possibly much later if history is to repeat itself.