While there has been considerable discussion on the potential for City banks to move desks to mainland Europe, there has been little consideration given to the impact of Brexit on the specialist financial sector that traditionally occupies West End Core offices, writes Knight Frank’s Head of Central London Research, Patrick Scanlon:

Occupiers from this sector have accounted for around half of all take-up in the West End Core over the last ten years, and have largely been responsible for the highest achieved rents.

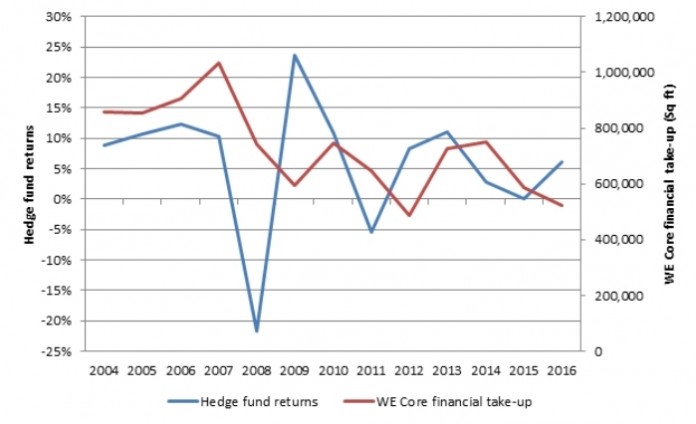

However, they are now acquiring less floorspace than at any point in this cycle or the last. By way of comparison, financial sector take-up in the Core in 2009, in the midst of the global financial crisis, was 593,000 sq ft; last year it was just 524,000 sq ft.

So, why is this happening and what does the future look like?

An analysis of hedge fund performance, measured by average returns, against WE Core financial sector office take-up shows that leasing activity in the Core appears to lag hedge fund performance by around 12 months. This can be seen particularly clearly over the last five years. In 2015, the slowdown in China’s economic growth and worries over oil prices, combined to drive hedge fund returns down, which translated into weak take-up in 2016.

Moving forward to 2016, hedge fund returns have bounced; perhaps this bodes well for Core financial take-up in 2017.

A recent survey by Preqin found that a quarter of hedge fund managers questioned in November 2016 believed Brexit would have a positive impact on their portfolio in the next 12 months, compared to 7% who predicted that the effect would be negative.

In terms of the effects of Brexit on the real estate market, 80% of UK-based hedge fund managers surveyed immediately after the referendum did not anticipate changing their location, and no fund managers stated definitively that they would move their business out of the UK.

Looking forward to the next 12 months, if hedge fund managers can generate strong returns from market volatility, there is every chance that there could be a continued increase in the acquisition of floorspace through 2018. Looking further ahead, the potential for post-Brexit financial sector deregulation could benefit the specialist financial even further.

However, if there is one thing we can be sure of, it is that the post-referendum world is full of twists and turns, and the path ahead is anything but clear.