Investor confidence in regional market assets has been confirmed in the third quarter with total investment in 2015 reaching £3.1bn, the highest total at the Q3 mark since 2007. This follows a quarterly increase of 73%, with investment volumes totalling £1.05bn during the quarter.

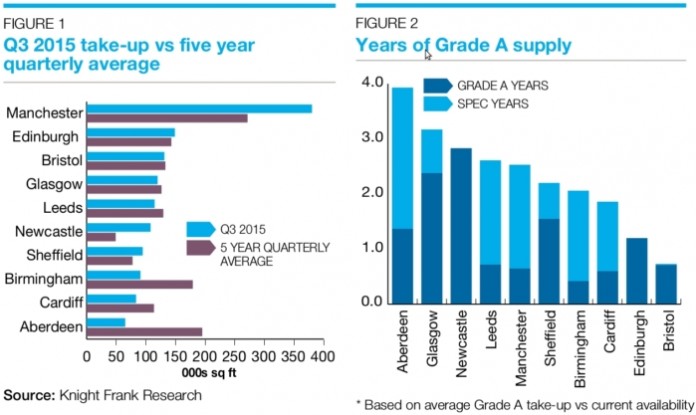

Although total let space across the ten regional cities was 36% less than the previous quarter, investor appetite is being supported by an overall improvement in the occupational market where the take-up for the year has now reached a five year high of 4.8m sq ft.

With investor demand increasing for regional opportunities, prime yields hardened in both Bristol and Sheffield during Q3. This continues the trend of yield compression recorded in 2015 with 8 out the 10 UK’s regional centres seeing yields harden. The largest movement since the turn of the year has been recorded in Bristol and Leeds with a reduction of 50bps.

Lee Elliott, head of commercial research at Knight Frank commented: “Regional opportunities have become more attractive to investors as leasing markets have strengthened. With the weight of money targeting markets outside London rising, we expect bidding to become more aggressive and place pressure on pricing.”

Highlights :

· Birmingham and Manchester accounted for 49% of total turnover in Q3, with significant transactions completing in both cities during the quarter.

· Following a slow second quarter, investor activity in Scotland picked up during the quarter, with £252m of stock transacted. This marks a threefold increase when compared to Q2 and is 45% above the 10-year average.

· Manchester accounted for the largest proportion of take-up with 379,976 sq ft transacted; 28% of the combined total. This represented an increase of 6% over the quarter and was notably 40% above the five year quarterly average.

· The largest increase in occupier activity was recorded in Newcastle where take-up more than doubled over the quarter to 107,812 sq ft. This increase represents the highest amount of quarterly take-up recorded in the city and has increased the year-to-date total to 208,120 sq ft, 34% ahead of the same period last year.

· The level of active requirements across the ten regional cities increased to 4.5m sq ft in Q3, a rise of 4.5% over the quarter, with the total at Q3 22% above the 5 year average.

· Prime headline rents remained stable across all centres during the quarter with the exception of Sheffield where rents increased by 15% to £23.00 per sq ft in Q3. Forecasts indicate that by the end of 2015 eight of the ten regional cities will have recorded rental growth during the year.

Stephen Hodgson, head of Knight Frank regional network commented: “The increase in occupier activity in the regions (somewhat behind the London curve) is good news and very fortuitous for those investors that entered the Regional markets first. This continuing trend will give longevity to the recovery in Regional Capital markets and should kick start much needed new speculative schemes.”