Glenigan, one of the construction industry’s leading insight and intelligence experts, releases the August 2024 edition of its Construction Review.

The Review focuses on the three months to the end of July 2024, covering all major (>£100m) and underlying (<£100m) projects, with all underlying figures seasonally adjusted.

It’s a report which provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals a unique insight into sector performance over the last 12 months.

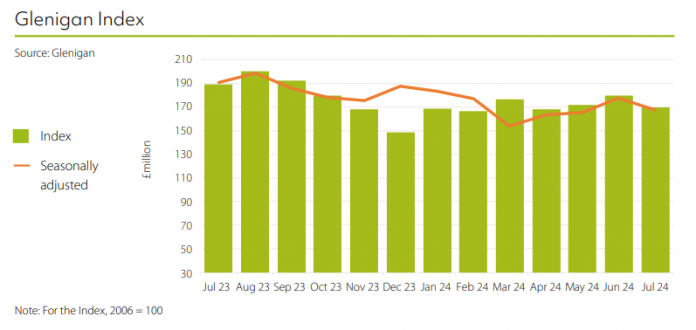

Averaging £10,198 million per month, work starting on site in the three months to the end of July increased 8% compared with the same period last year.

This uplift was attributed to a significant spike in major project-starts which rose considerably, increasing 42% compared to 2023.

However, this growth was tempered by a decline in underlying project-starts which were down 11% on the previous year despite inching up (+2%) against the preceding three months.

Overall, work starting on site failed to grow on the preceding three-month period, declining 10% during the three months to July.

Commenting on the figures, Glenigan’s Economic Director, Allan Wilén says, “Construction activity is showing encouraging signs of recovery, with starts on site up 8% compared to last year and main contract awards reflecting a steady 3% year-on-year growth. This momentum indicates a cautiously optimistic outlook within the industry, particularly as the new government’s planning reforms begin to take shape.”

Main contract awards fell 9% against the previous three-month period, but pulled slightly ahead of last year, rising 3%. Drilling into the data, major contract awards were responsible for this slight growth, advancing a third on the year before. Underlying contract awards, however, declined 5% against the preceding period and 11% compared to 2023 levels.

Planning approvals were down across the board, dropping back 6% against the previous three months and 32% on a year ago. Major planning approvals fell 12% against the preceding period, with the value decreasing by 54% on last year. Underlying planning approvals increased 6% on the preceding three months, but finished 5% lower than the same period in 2023.

The sector-specific and regional index, which measures underlying project performance, saw modest growth during the three months to the end of July 2024. Residential construction experienced a particularly healthy period, contributing to a 2% overall growth in underlying starts.

Taking a closer look at the highlights…

Residential starts going strong

Underlying residential starts increased 12% during the three months to July, despite falling back 17% on the year before.

This overall boost was attributed to a spike in private housing starts, which rose by 25% following a weak start to the year as developers’ sentiment toward the prospects for the housing market improved. Despite the upturn, starts were still 12% lower than a year ago.

Social housing work starting on site remained depressed, dropping by 23% against the preceding three months and being 32% down against the previous year.

Prison starts jump tenfold amid Community & Amenity decline

Underlying community & amenity project-starts fell 44% compared to the preceding three-month period to stand 8% down on last year.

Underlying contract awards experienced a weak performance, decreasing 52% against both the preceding three months and the previous year.

Underlying approvals were also down 51% (SA) on the previous three months, and 47% on 2023 to total £142 million.

Major community & amenity projects (>£100 million) fared better compared to the same period last year, when no major projects started on site. Major approvals also increased on the preceding three-month period and on the same time last year.

Totalling £205 million, prisons accounted for the highest proportion (50%) of community & amenity starts, with the value jumping more than tenfold on a year ago.

Regional Outlook

Refreshingly, regional performance was generally impressive.

Yorkshire and the Humber and Scotland performed strongly, with the value of starts rising by 10% and 4% during the three months to July and up 5% and 4%, respectively, on a year earlier.

Other strong performers included the East Midlands, which experienced a 33% rise in starts against the preceding three months but was still 11% lower than a year ago.

The South West, Wales, and Northern Ireland also experienced double-digit growth of 16%, 10%, and 39% respectively against the preceding three months, but the value of starts remained down from a year ago.

London experienced a 9% rise against the preceding three months but was 20% down against the previous year.

By contrast starts in the East of England, the North East, and the North West declined by 7%, 23%, and 10% respectively against the previous three months.