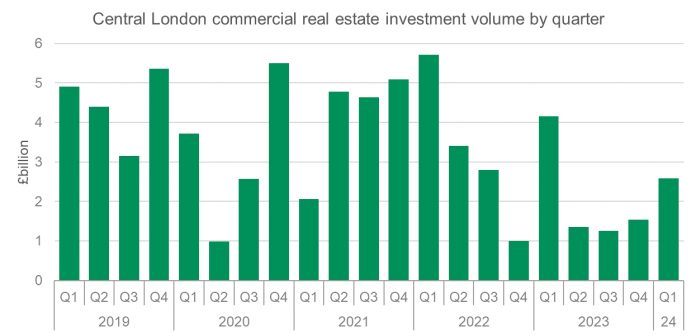

Commercial real estate investment volume in London has recorded two consecutive quarterly increases, according to analysis from BNP Paribas Real Estate.

The final quarter of 2023 saw investment volume in the capital city surge 23% to £1.5bn. Provisional analysis of Q1 2024 reveals another jump to the region of £2.5bn. While both quarters are still below the long-term average, the data indicates the start of the recovery and a new investment cycle.

Charlie Tattersall, Senior Associate Director, Research, commented: “UK real estate markets remain highly-driven by interest rates movements, but attractive fundamentals, including the anticipation of the first base rate cut in June, and signs of a trough in pricing, are gradually bringing more investors back to the market. Almost two years of outward yield shift means some market segments are offering decade-high income returns. Combine this with the window for capital value declines closing, this represents more evidence of the attractiveness of today’s pricing and so capital which has been on the side lines is starting to play.”

Fergus Keane, Head of London Capital Markets at BNP Paribas Real Estate, said, “Confidence has been missing for two years, but if you look at our data on the market, two consecutive quarterly increases in investment volumes certainly signals the start of its return. It’s often only with hindsight that you can see when one cycle ends and another begins, and the trigger is often a spate of deals that turns sentiment and begins to build real momentum. It’s clear to me that some of those moments have arrived.”

Keane points to series of market activity which support the view the market is liquid and the process of price discovery has completed. These include:

- Blackstone’s £230 million deal at 130-134 New Bond Street at sub 4% is a boon for the retail sector and reflects a core play with core plus returns potentially on offer.

- BT group’s £275 million sale of the BT Tower to MCR hotels is a huge display of confidence.

- Nomura’s £64 million purchase of 55 St James’s Street at 4.25% also suggests core money may be returning.

- Royal London’s £192.5 million purchase of a 50% stake at British Land’s 1 Triton Square is a perfect demonstration of the beginnings of a shift in sentiment.

Keane continues, “There is naturally still hesitation in the market and some are holding out for further evidence that the challenges of 2023 are behind us. A small proportion of investors appear to believe capital values will soften a little further. Another slice appears to be anticipating more bank-led sales at bargain prices, while others are waiting for stock levels to rise, given the fact that some potential sellers think they’ll get a better price later this year. But the activity in the market is increasingly contradicting these positions and I am confident that we are now at the start of a new investing cycle.”

BNP Paribas Real Estate also points to strong rental prospects across the office sector which will support the early signs of recovery.

- Prime office yields in the West End and City markets are steady at 4 – 4.25% and 5.75% respectively.

- Prime West End office rents are running at £150 psf, 7.1% higher than a year earlier, and the firm forecasts 14% growth through to 2026.

- Prime office rents in the City stand at £75 psf and are forecast to climb by around 9% through to 2026. The best spaces already command £95 psf

Tattersall concluded, “It remains the case that those who are able to overcome financial market volatility and deploy capital are likely to reap the rewards of inflation-beating rental growth in the years to come. Early movers that are able to offer best-in-class business space into a recovering market stand to make sizeable gains as borrowing costs fall.”